*This post may contain affiliate links, which means I may receive commissions if you choose to purchase through links I provide (at no extra cost to you). Thank you for supporting the work I put into this site!

Are you interested in diversifying your portfolio? In this blog post, we will be looking at my top UK investing and saving apps, which could help diversify your assets. It’s always good practice to have money in different sectors and companies, rather then relying on one investment, because this can create an unwanted risk to your capital. As the saying goes, “don’t put all your eggs in one basket”. With multiple assets, the decrease in value from one investment, may be compensated by a value increase from another investment, thus serving as a safety net. Also, bear in mind that some investments will carry more risks then others.

A lot of the apps I now use, came apparent to me because of their sign up offers, which just shows the power of marketing and freebies. Check out my offers page to get up to £1195 worth of free money, just from sign up offers. Even if you don’t want to make long-term investments, it may be worthwhile signing up just for the free money. If I find new investment opportunities, I will update this page.

If your reading this, you may also be interested in how to make free money using apps.

Disclaimer

All trading and investing involves risk. Profits are not guaranteed. Only risk capital you’re prepared to lose. Past performance is not an indication of future results. This content is for educational purposes only and is not investment advice. The following apps are my personal recommendations. All opinions are my own.

General Investment Account (GIA) Vs Stocks & Shares ISA

Before you open an account with any of the companies below, it is a good idea to familiarise yourself with the difference between a GIA and an ISA.

Stocks and Shares ISA

The main benefit of having a Stocks and Shares ISA is that it allows you to invest up to £20,000 each year without having to pay Capital Gains Tax or UK Dividends Tax. The problem however, is that you can only put money into one Stocks and Shares ISA per financial year. You can open up other Stocks and Shares ISA accounts within the same year, but you can only fund one of them. You should therefore choose the right Stocks and Shares ISA that is most suitable for you, taking into consideration fees and risk factors.

Also bare in mind that the £20,000 ISA allowance can be spread across different ISA types, including Cash ISA, Lifetime ISA, IFISA, and Junior ISA. Check out Money Saving Expert’s post for more information on the five types of ISA and the ISA allowance.

General Investment Account (GIA)

For a GIA, you will have to start paying Capital Gains Tax after earning £12,300 in Capital Gains, whilst also paying Dividend Tax after earning £2000 in Dividends. As you can only fund one Stocks & Shares ISA, most of your investment accounts will have to be opened as a GIA. Lucky for you though, most GIA’s are completely free to open with no monthly costs, whereas, Stocks & Shares ISA’s often have monthly costs to keep open.

Freetrade

Freetrade is probably my favourite trading app, with it’s simple and beginner friendly interface. The company won ‘Best Online Trading Platform’ in the British Bank Awards 2020. I believe the company will keep growing, so I even invested in the company itself when it went onto Crowdcube (see further down). The first thing that attracted me to Freetrade, was their sign up offer. You can get a free share worth £3 – £200 when you deposit just £1. The free share can be sold and withdrawn for money (after 30 days). If the free share is a small amount, I would leave it as an investment, because it might increase in value. You can also get extra free shares via giveaways or referrals.

On Freetrade, you can either have a free account, or there is an option to upgrade to Freetrade Plus for £9.99/mo to access extra benefits. This includes thousands of additional shares, the option to limit orders (set a price for when to buy and sell shares), earn 3% interest on up to £4000 cash between trades, plus more. Unless you want all the benefits, I wouldn’t upgrade solely for the interest because it works out that 3% interest on £4000 (£120), is the cost of Freetrade Plus for a year (£119.88), so no profit would be made, especially if you don’t have the maximum of £4000 cash in your account.

Pro’s

- Free share worth £3 – £200

- Simple and easy to use interface with good aesthetics

- Low minimum deposit of £1

- Commission free investing

- Fractional shares, US & UK stocks, ETFs and Investment Trusts

Cons

- The 3% interest on £4000 is only enough to pay for a year of Freetrade Plus

- Don’t have access to all the stocks and shares on the free account

Available on App Store & Google Play

CIRCA5000 (Formerly Tickr)

CIRCA5000 is a really great app that focuses on investing in companies who aim to make a positive impact on the environment and the world, which is definitely what the planet needs. Using the app will help to offset your carbon footprint. When opening a Stocks and Shares ISA with CIRCA5000, you can choose out of the three themes: People, Planet, or People and Planet. Furthermore, you can select the risk level of your ISA.

As an incentive for signing up for CIRCA5000, you can get £15 for free + 2 trees planted (in Indonesia) in your name. Simply download the CIRCA5000 app, use code dannyh6892 during sign up, then deposit a minimum of £5. The £15 free credit isn’t invested, but it can be withdrawn after 90 days, as long as you keep the £5 invested for 90 days. Alternatively you can ask to have the £15 credit invested after 90 days. A CIRCA5000 GIA or ISA account costs £1 per month, plus 0.5% p.a. of the balance of your account. You can cancel at any time.

CIRCA5000 has a lot of great features to help increase your investments. You have the option to round up your spends and invest your spare change. Grow your savings on autopilot with a monthly top-up of your choice. You can also sign up to sustainable partners of CIRCA5000 to get credit added to your account. They currently have a £100 offer when purchasing life insurance.

Pros:

- £15 free + 2 trees planted on sign up and £15 for each referral

- Invest in companies positively impacting the planet

- Regular competitions & referral boosts

Cons:

- Account is not free and costs £1 per month + 0.5% p.a. of investments.

Available on App Store & Google Play

eToro

eToro (eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk) was my very first trading app that I downloaded, which I have had for years now. I also done a full blog post about eToro and how to make money copying professional traders.

One of the best features of eToro and the main reason I still use the app is their CopyTrader feature, which enables you to allocate a set amount ($200 minimum) of your funds to another trader and automatically copy all the trades they make, without lifting a finger. So if your a novice at trading, then this is a great place to start because you can select a successful, reliable trader, click copy, then sit back and let the professionals do all the hard work for you. You can also invest in CopyPortfolios, which will automatically copy multiple markets or traders based on a predetermined investment strategy.

For anyone who does know how to trade successfully, you could earn a second income on eToro by being copied by other clients on the platform, with the top popular investors, earning yearly payments of up to 2.5% of their AUM (assets under managament), on top of any profit made from their own investments.

Pros:

- CopyTrade feature for copying professional traders automatically.

- Trade and invest in cryptocurrencies, stocks, ETFs, currencies, indices and commodities

- Switch easily between your virtual portfolio and real portfolio.

- Earn extra income from being copied by other members.

Cons:

- $50 is the minimum for a deposit (first time deposit may vary) and $200 for copying a trader.

- Fixed fee of $5 per withdrawal transaction + currency conversion fee (50 pips for USD – GBP). Minimum withdrawal is $30.

Available on App Store & Google Play

Swissborg

I have only recently started using Swissborg, but I was instantly impressed by its modern style, design and easy functionality. Swissborg also have a great sign up offer. Get €1 – €100 worth of free CHSB after depositing a minimum of €50 or equivalent currency. You can immediately exchange your free CHSB for GBP and then withdraw it, alongside your original deposit too. Withdrawals cost 0.1% or a minimum of £1. Deposits can be made via bank transfer but make sure it’s in the same name as your Swissborg account.

Swissborg even has it’s own cryptocurrency token called CHSB, which has growth rate of over 5000% increase within the last year, so it may be worth keeping your free CHSB as an investment as it may continue to grow (info as of 22/03/21). There is also the chance of winning 250 CHSB tokens by earning all 16 badges in the Swissborg Community app (get 3000 points from sign up using my code VWC6QMI), which is a separate app to the Wealth app.

With Swissborg, you can also earn a passive income with ‘Smart Yield’, which can help you earn the following rates (updated daily on their site) on these available assets (accurate as of 23/03/21):

- USDC – Up to 20.11% p.a.

- CHSB – Up to 5.35% p.a.

- ETH – Up to 14.89% p.a.

Just to note, you will have to become a premium member to earn the maximum rate. Rates are updated daily and yields are paid out daily.

Some of the Swissborg supported assets, includes: Bitcoin (BTC), Ethureum (ETH), SwissBorg Token (CHSB), USD Coin (USDC), Compound (COMP), plus more.

Pros:

- Get up to £100 worth of free CHSB

- Great design and simple to use.

- Earn free crypto via the Swissborg Community app.

- Earn daily ‘Smart Yield’ income on certain assets

Cons:

- Deposits need to be made via bank or swift payments (no card payments)

- Less available crypto assets then other exchanges, but list is growing

Available on App Store & Google Play

Trading212

Trading 212 is the UK’s number 1 trading & investing app (based on number of downloads) and is similar to Freetrade, with a good sign up offer too. Get a free share worth up to £100 when you sign up and deposit a minimum of £1. When signing up, you can choose to open an Invest account (free investing in Stocks & ETF’s); CFD account (CFD’s on Stocks, Forex, Indices and more); or ISA account (invest tax free in zero commission Stocks & Shares ISA).

Trading212 has recently added a Pie section, which you can use to diversify your portfolio. To create a pie, select from thousands of Stocks & ETF’s to become slices of your pie. You can adjust the proportions of each slice and create a fully automated investing plan that matches your goal and budget. If you are unsure where to start, you can always copy another members Pie within the Pie library. I plan to invest in the ‘(Almost) Daily Dividends’ pie, which seems to be very popular, with 37.6k followers. There will be a minimum investment amount for each pie, which will be dependent on how many slices within each pie.

Pros:

- Free share worth up to £100

- Invest in pies (a collection of different Stocks & ETF’s)

- Can switch between practice and real money

- Invest from as little as £1 with zero commission

Cons:

- New member sign ups not always available

Available on App Store & Google Play

Chip

Chip can be used as a savings account and if you gain access to Chip+1 then you can get a 1.25% bonus on your savings, which is far higher then a lot of leading banks. One of Chip’s best feature is their auto-save setting, which automatically takes small amounts of money from your connected bank and saves it in Chip. To know how much to save, Chip’s AI analyses your transactions and calculates what you can afford to save every few days. You can set the auto save level, the minimum bank balance needed and you can have the savings stopped if you go in your overdraft. You can also skip auto saves, cancel an auto save, or simply stop them completely.

The first £100 you auto-save with Chip’s AI is a free trial. After your trial ends, you can either pay £1.50/28 days to keep using auto-save, or you can choose the free ChipLite plan for unlimited manual deposits.

Use code MU6VXAYZ to gain access to a Chip+1 account with a 1.25% bonus.

In the future, Chip will also be giving users the opportunity to open up an ISA or GIA, which will be powered by BlackRock. For now, you can only sign up for the waiting list of the Chip Investment accounts. Access will be rolled out to Chip’s Shareholders first and then the rest of the Chip userbase shortly after.

Pros:

- 1.25% bonus on savings each month

- AI auto-save feature

- Investment accounts coming soon

Cons:

- To access Chip+1, you need to refer someone else to Chip (they plan on changing this)

- Only the first £100 auto-save is free (£1.50/28 days thereafter)

Available on App Store & Google Play

Moneybox

Moneybox works in a similar way to Tickr, but with more account options, including: Stocks & Shares ISA, General Investment Account (GIA), Lifetime ISA, Savings Account, and Personal Pension. Open an account from as little as £1.

A Lifetime ISA is a good option for anyone wanting to buy their first home, or save for later life. To be eligible, you must be 18 or over but under 40. With a Lifetime ISA, you can put in up to £4,000 each year until you’re 50. The government will add a 25% bonus to your savings up to a maximum of £1000 per year.

Moneybox is another good app for making savings on autopilot:

- Round Ups – Round up your everyday purchases to the nearest pound (use multiple connected banks).

- Weekly Deposits – Set up a weekly amount to deposit.

- Payday Boosts – Choose an amount to deposit on your payday.

- One-off Deposits – Deposit manually whenever you like.

Another good feature of Moneybox is their ‘Discover’ section. Here, you can read blog posts about saving money, look at your saving stats; or visit and purchase from online stores to get rewards for your Moneybox account.

Pros:

- Open an account from as little as £1

- Good auto-save options and rewards section

- Multiple account types available

Cons:

- No sign up bonus

Available on App Store & Google Play

Another app that is similar to Moneybox, is an app called Plum. With Plum, you can also earn £15 free each time you make 3 successful referrals, so it may be worth signing up just for the free money. Earn £15+ with the Plum app.

Earn Free Cryptocurrency

If you don’t have spare money for investing, or simply don’t want to risk investing your own money, you could earn free cryptocurrency instead. This could also be good for anyone wanting to boost their investments. There are a few apps that enable you to earn free cryptocurrency, which may be via cloud mining, referrals, performing tasks, giveaways, etc. For more info on these apps, visit the Money Making Apps page.

- BEE Network – Join my hive by using code moneyskipper during sign up and mine for free BEE on your phone. The more members in my hive, the higher your hourly BEE earning rate.

- Pi – Mine for Pi crypto via the cloud. Pi has no worth currently, but may be a good investment. After following my link, use moneyskipper as your invitation code.

- Coin – Geomine for COIN, which can be used for getting cryptocurrency, electronics and other products.

- StormGain – Mine for Bitcoin every 4 hours. At the lowest level, earn 0.00003 BTC daily (value and rewards can vary).

- Cointiply – This is a Bitcoin faucet, so there are multiple ways to earn free bitcoin, such as hourly giveaways.

- Phoneum – This app mines for PHT cryptocurrency via the cloud. Use code p6vp1h35 to receive 200 PHT bonus. Phoneum also powers 5 other associated apps, which can help you earn even more PHT, plus other cryptocurrencies for free. This includes Green Karma (use code ps4kx5qw to get 200 Oxygen and 200 XP Bonus); Crypto Planet (use code pye767sf to get 200 Crystals and 200 XP Bonus); Crypto Treasures (use code p6vp1h35 to get 200 Gold and 200 XP Bonus); Crypto Cards (use code 87r4txhh to get 200 PHT crypto and 200 XP Bonus); and Crypto Connect 3.

- Freebitco.in – Win free bitcoin hourly and in the weekly free lottery, plus earn more via referrals, playing Hi-Lo or earning Bitcoin interest.

- Mobilio – Earn points for not using your phone whilst driving. Points can be converted into Mobilio currency, which can hopefully be used as cryptocurrency in the future. Use code p4nr5o to get 50 bonus points

- Swissborg Community – Have the chance to win free Bitcoin by predicting whether Bitcoin will go up or down within 24 hours. Use referral code VWC6QMI to get 3000 points. You can also complete challenges to earn CHSB Tokens, which can be transferred to the SwissBorg Wealth App.

- Coinbase – Coinbase is a cryptocurrency exchange site, however there is a section, which allows you to earn different crypto by completing simple quizzes or making referrals.

Cryptocurrency Sign Up Offers

Further ways to earn some free crypto is via sign up offers. I will list the offers I have claimed myself below. From these offers, you can earn between £51-£136 (values may vary) Check out Free Money Offers page for lots more sign up offers.

Mode – Sign up to mode via this link then buy £100 worth of Bitcoin (BTC), or open a Bitcoin Jar (Need a minimum of 0.01 BTC). You’ll then receive £10 worth of free BTC within 24 hours. You can then sell your BTC and withdraw your initial deposit and free money. Buying and selling BTC using GBP or EUR balance incurs a 0.99% fee, so £0.99 for £100 deposit.

Luno – Sign up to Luno via this link, verify your account, enter the code 59BUK5 on the “Rewards” page, deposit and buy £100 in Bitcoin (Luno exchange not included), then you will receive £10 worth of free bitcoin. Available on App Store & Google Play.

Swissborg Wealth App – Download the Swissborg app via this link and deposit £50 to get up to £100 of free Bitcoin (BTC). You can immediately exchange your free BTC for GBP and then withdraw it, alongside your original deposit too. Withdrawals cost £1. Available on App Store & Google Play.

Coinbase – Join Coinbase via this link to receive £7.21 ($10) of free bitcoin once you have brought or sold at least £72.10 ($100) of cryptocurrency. Terms and conditions apply and GBP values may change depending on exchange rate. Bitcoin can be exchanged for GBP. The £72.10 you use for buying cryptocurrency, can then be exchanged back to GBP and withdrawn too. Selling and withdrawal fees apply. Available on App Store & Google Play.

Coinbase Rewards – Coinbase also has a rewards section, in which you can also receive $31 worth of various cryptocurrency for free, simply by completing short quizzes about the cryptocurrencies. Check the rewards section every so often, because new cryptocurrencies may get added or replaced. Currently, you can earn $3 of The Graph (GRT), $3 of NuCypher (NU), $10 Stellar Lumens (XLM), $9 of Compound (COMP), and $6 of Celo (CGLD). Since earning these free rewards, they have grown to a total of £48.17 + £10.57 from previous free rewards, thus resulting in a free cryptocurrency portfolio worth £58.74 (correct as of 22/03/21). So I highly recommend signing up to them.

Get Free Shares

Get free shares easily by performing sign up offers and via referrals, or for further offers, Click here to get up to £1038 worth of free money.

Stake – Sign up to Stake via this link (or use code dannyh485), deposit £50 within 24 hours of signing up and spin the wheel to win a free stock. You will either get a GoPro stock (approx. £4 value), Dropbox stock (approx. £17 value), or Nike stock (approx. £90 value). Stock values subject to change. Deposit fee is $2 and withdrawal fees are $4. Deposits in GBP get converted into USD, then back again for withdrawals. Depending on stock values and which one you receive, you may not profit from this offer.

Orca – Download the Orca Investment App to get a free share worth between £2 – £200. Use referral code BBLGG, deposit £50, next you must buy 3 different assets, then you will receive your free share. Note: You won’t be able to sell your free share for 30 days and there is a £1 fee on each trade.

Getbux UK – Join the waitlist to get a free share worth up to £100 when you sign up to Getbux using this referral link. Limited to the first 100,000 users.

Freetrade – To get a free share worth up between £3 – £200, sign up to Freetrade via this link, download the app, deposit £2 into your account and receive a mystery free share in your account within 7-10 days.

Trading 212 – To get a free share worth up to £100, Simply sign up for a Trading 212 Invest/ISA account via this link, then deposit a minimum of £1 into your account. You can sell the free share immediately but can’t withdraw the cash value for 30 days.

Other Investments & Savings

Everup

Everup is a completely different way of saving because it combines saving money, with winning money and I love the chance of winning free money. The main principle of Everup is “the more you save, the more you can play and the higher your chances of winning tax-free money!”

Join Everup (use code RMON611912NCREYW) and create a free cash account to receive £5 – £100 free cash + 500,000 virtual coins. This offer ends 28th Feb, 23:59 GMT. Everup is currently on the App Store and Google Play.

There will be chances to win up to £1 million in their ‘Million Lotto’ Weekly Lotto, which you can enter using virtual coins (25K per entry). Virtual coins be gained in various ways, such as playing the Spin & Win games, via referrals or from topping up your account. The more money you have saved in your account, the higher the amount of daily coins you can earn for free.

There is also a Daily Raffle to enter for free, which gives £10 to the first place winner (I’ve won this once so far). You get 1 additional entry into the Daily Raffle for every £1 you have in your account.

Every day you also get 2 free spin on the London Wheel and 1 free spin on the Montecarlo wheel, for a chance of winning up to 10M virtual coins.

You also get the chance of winning extra money on the Manchester and Jakarta scratchers, both of which give out prizes of up to £5. You get 1 free daily scratch on the Jakarta scratcher, however you need to use 100k virtual coins to have a go on the Manchester scratcher.

An extra bonus of Everup, is the fact that it’s completely free, with no minimum spends, no monthly fees and no commitments. However, in order to be eligible to play in the Weekly Lotto and the Daily Raffle, you must have at least £15 saved in your Everup account. To have access to everything, including the Manchester scratcher, you must have at least £25 saved in your account.

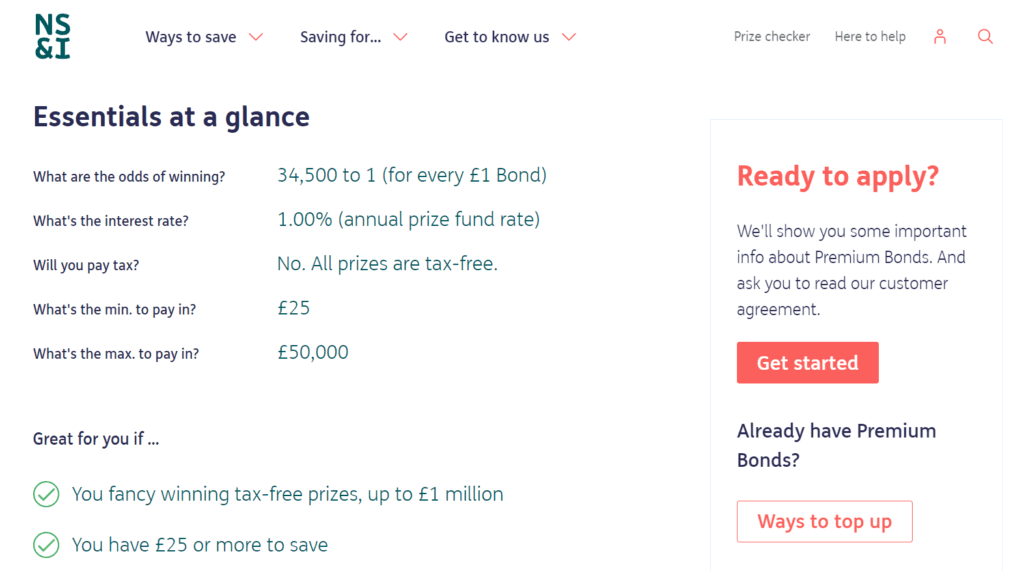

Premium Bonds

If you have some spare money sitting around in your bank account or in a savings account with poor interest, then you could consider moving it to a Premium Bonds account for free. Having a Premium Bonds account gives you a chance of winning money for free each month. The more money you have in premium bonds (max £50,000), the higher your chances of winning tax-free money each month. The odds of winning is 34,500 (for every £1 bond). There is a 1.00% interest rate on the annual prize fund rate.

Over 3 million prizes are given out to random bond holders every month, with prizes ranging from £25 – £1 million. You can choose to have your winnings automatically re-invested into your account so that you have a higher chance of winning more, or you can select to have it paid directly into your bank.

The minimum amount you need to open up an account is £25, therefore I would recommend opening an account just to have at least the minimum £25, because you may be lucky enough to win on any random month. or you can set up a premium bonds account for children under 16.

There isn’t an official premium bonds app, however there is a dedicated app for checking the premium bond results. Available on App Store & Google Play.

Seedrs

Seedrs is a really great crowdfunding site that gives you the chance to make investments in start-up companies, that you see potential in. There is however a lot of risk involved in this type of investment, so only invest what you can afford to lose. Read the following statement shown on Seedrs:

Investing involves risks, including loss of capital, illiquidity, lack of dividends and dilution, and should be done only as part of a diversified portfolio. Please read the Risk Warnings before investing. Investments should only be made by investors who understand these risks. Tax treatment depends on individual circumstances and is subject to change in future.

To get you started in Seedrs investing, you can get £25 free credit to use on Seedrs when you sign up via this link and successfully invest £150 (through one or more investments) or more within 30 days of signing up.

Even though most start-up companies fail, there is also a lot of potential profits to be made for companies that become successful. As they are start-up companies, their share prices are often very low, therefore there is an opportunity to buy a lot of shares at low costs.

Seedrs also has a great ‘AutoInvest’ feature that you can customise to automatically invest up to your maximum set amount, into companies that match your defined criteria. You can pause the AutoInvest option at any point. No investments will be made if funds are too low in your account.

Unfortunately Seedrs doesn’t currently have an app available, but hopefully they will develop one in the future.

Crowdcube

Crowdcube is a site and app that works in a similar way to Seedrs, in which you can invest into companies that you believe in. I use Crowdcube alongside Seedrs because they have different companies listed on their sites.

From using Crowdcube, I’ve actually invested money into 3 companies listed on this blog post, including Everup, Chip, and Freetrade. Hopefully these companies will become successful and I will see some return in the future.

Available on App Store & Google Play

Future UK Investing Opportunities

Below will be a list of sites or apps that will become available in the near future, however you may be able to join a waiting list for them now.

Proptee

Join the waitlist and get early access to Proptee. Proptee is a real estate stock exchange, which enables you to buy shares in properties and thus receive part of the monthly rent from tenants each month. The great thing about Proptee is that you only need £1 to start investing in property. I can’t wait to give the app a go when it’s available.

Leave a Reply